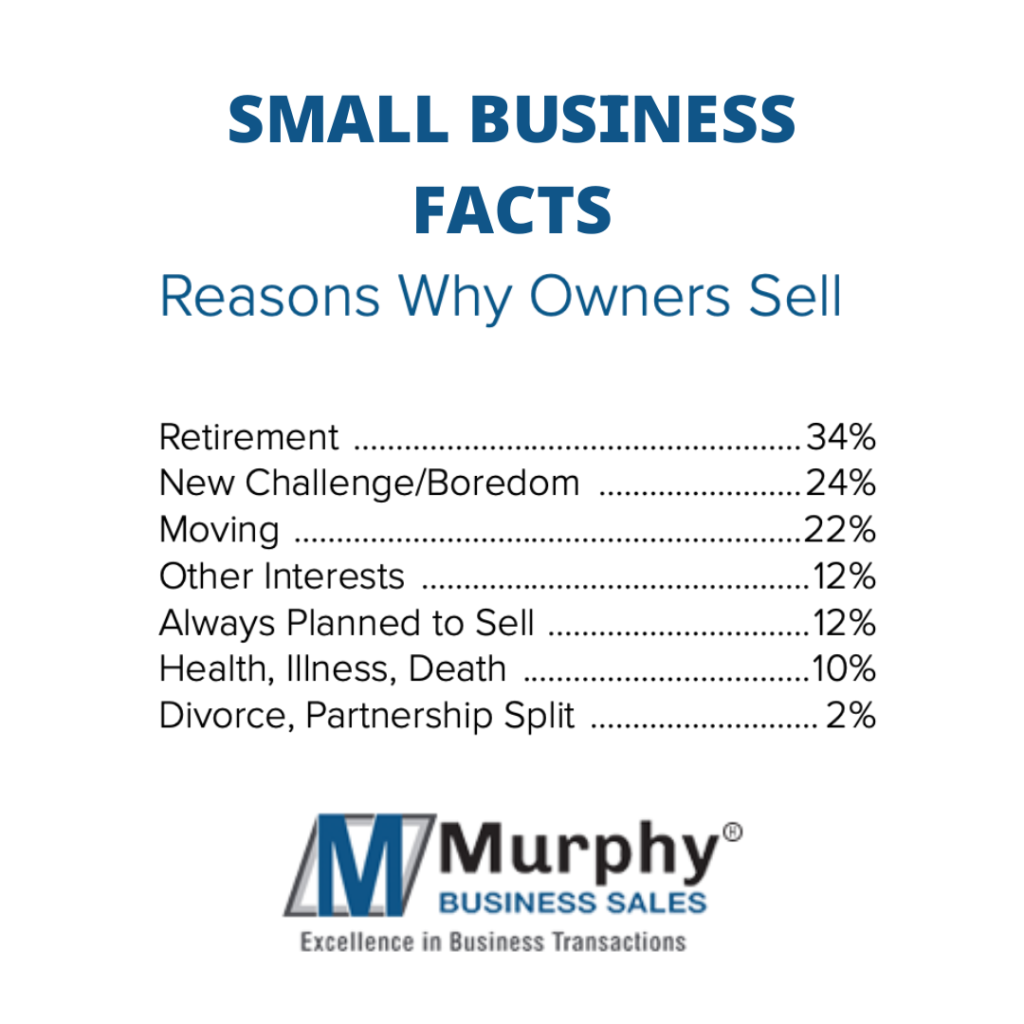

Reasons Why Business Owners Sell: As the owner of a business, you face many tough decisions nearly every day. One question you may have asked yourself from time to time is whether you should sell your company. Several factors can influence your decision to sell, some of which you may not have even thought about. Here you will find a comprehensive list of possible reasons to help you decide if and when selling your business is right for you.

It’s at a High Point

Over time, most businesses face different cycles of highs and lows, and potential buyers prefer to acquire companies that are on the way up and have a positive future outlook. When your company is performing well, and profits are high, you can opt to sell to get the maximum value in a sale. You may not be ready to retire or move on, but if you sell at the right time, you can make the most money possible and pave the way for a more secure financial future. This can also help you avoid selling at a later date for less value, which would mean less money for your retirement.

Risk? You’re Over It

Taking chances is inherent to owning and growing a business. And taking these risks are something you may have been more inclined to gamble with during the early stages of your company’s lifecycle because you didn’t have as much to lose. However, as your business thrives and increases in value, risk can seem even riskier, especially if you are getting older and closer to retiring. This can become exhausting to a point where you act so conservatively that it begins to impede growth opportunities, which can negatively impact your business valuation. Selling your company while it is doing well can help you get out while things are good and let someone else assume the burden of worrying about risks.

Revenues Are Down

Sometimes factors out of your control can impact your company’s profitability, such as an economic downturn. This is when you should assess whether it is worth it to stick with it and see if you can weather the storm or choose to sell while there’s still some value there and move on to your next act. It may simply be a matter of getting off a sinking ship before it’s too late. In some cases, you may find buyers out there with the right resources to turn the business around.

Time for Change

You’ve built a successful business. Maybe you feel like your work here is done. But, sometimes, entrepreneurs can’t shake that entrepreneurial spirit. Some don’t even enjoy running the day-to-day of a company. If you find yourself itching to pursue other opportunities, it may be wise to sell so that you can focus on new ventures. Your company may be better off in the hands of someone who has the passion for running it while you profit from a sale and are freed up to start the next big thing.

You’re Burnt Out

Running a business is hard work. It is fairly common for business owners to cite burnout as their reason for selling. Maybe you’re tired of being kept from spending time with family. Maybe you feel like you can’t maintain a personal life. Or maybe you feel that being consumed in work is having a negative impact on your health. These are all excellent reasons for considering a sale, especially if you find yourself neglecting your company out of fatigue and frustration. Again, it’s better to sell when business are still good rather than waiting for things to go downhill.

Sector Shifts

Certain impending industry changes can affect the sale-ability of your business. This can include regulatory issues or new legislation, or new competition armed with innovation that will render your product or service less relevant. You will want to get ahead of these changes and sell your business while remaining transparent with buyers about the issues they may face in the future. Selling to a competitor could even be a solution that makes sense for both parties involved.

A Need for Capital

You may reach a point when you simply need capital, whether it is to retire comfortably, to start a new venture, or you need cash to cover an emergency. You should keep in mind that it usually takes several months to sell a business so this shouldn’t be considered a quick fix. But it can be a way to raise some capital if you need it, as long as you’re prepared to be patient.

Retirement

Planning for retirement is a common reason to sell a business. There are a few ways that you can go about this. You can sell the business outright to finance your nest egg. You can create a succession plan and leave the company to a family member. Or you can sell to an employee or a business partner. In any case, you should work with an M&A advisor to facilitate the best sale scenario for your needs properly.

The Importance of an Exit Plan

The bottom line is that business owners should always have a plan in place for exiting their investment, regardless of how close you are to retirement. It is simply a smart business decision because it protects both the owner and the business. It can also drive up the company valuation in a sale because proper preparations have already been established, and it shows that you’re serious as a seller when the time is right.

About Us

Providing business owners of large main street and the lower middle market sized businesses (between $1 million and $25 million in revenue) with creative, value-maximizing solutions for exiting their businesses. To date, Murphy Business Services has handled engagements in excess of $2.1B across various industries in North America. With decades of M&A experience, Murphy Business’ Eastern North Carolina deal team have assisted owners with achieving their personal objectives. Our Business Intermediary and M&A experts can help you figure out if you are ready to sell your business, create an exit or succession plan, and find the right buyer. We look forward to starting the conversation about the possibilities that your future holds.