“Unveiling SBA Insights: An Open Dialogue with Allen Thomas, SBA’s Southeast Administrator”

Insights for Aspiring Sellers and Discerning Buyers

For those contemplating the sale or acquisition of a business, you’re embarking on a journey filled with opportunities and complexities. In this intricate process, the Small Business Administration (SBA) can be an invaluable ally. Just last week, I had the privilege of hosting a Q&A session with Allen Thomas, the Southeast Administrator of the SBA, during the Murphy Business Education Conference. This exclusive event was tailor-made for entrepreneurs considering Murphy Business to facilitate your business transactions. In this session, we unveiled essential insights into the SBA’s mission, its vision, and how it can be a pivotal player in helping you realize your business aspirations.

Deciphering the SBA: Fueling Small Enterprises

The Small Business Administration transcends being just an agency; it is devoted to fortifying the backbone of our economy – small businesses. It’s mission is simple, yet profoundly significant: to empower Americans on their entrepreneurial voyage. This empowerment takes many forms, from facilitating access to capital, providing entrepreneurial development programs, and fostering government contracting opportunities, to championing small business interests. Whether you’re a small business owner contemplating a sale or a prospective buyer seeking opportunities, collaborating with a broker and grasping the SBA’s role is essential.

A Unique Perspective: Allen Thomas’ Insights

As the Southeast Regional Administrator of the SBA, Allen Thomas offers a unique vantage point. His jurisdiction spans eight states, including Alabama, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, and Florida. These insights hold particular value for business sellers in these regions. Notably, the SBA operates across ten regions nationwide, ensuring widespread resources for small businesses.

Market Dynamics and Financing Revelations: A Detailed Examination

In our Q&A, we delved deep into the ever-evolving landscape of SBA financing. Allen shared noteworthy trends, particularly concerning loans of different sizes:

- Loans in the $0-$350,000 range have seen fluctuations, but recent indicators point to progress in FY23.

- Loans in the $350,000 – $2 million range witnessed substantial growth in FY21, with a temporary dip in FY22. FY23 shows signs of stabilization.

- Loans exceeding $2 million have encountered ups and downs, influenced by the broader economic context.

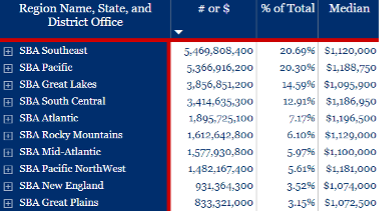

A Regional Triumph: Southeast Shines

One remarkable revelation was the Southeast Region’s ascent under Allen’s leadership. It has now become the top region for SBA financing in the $500,000-plus range, surpassing even the Pacific Region. This accomplishment underscores the vibrant small business community in the Southeast and the efficacy of SBA initiatives in the region.

Thriving Sectors and Entrepreneurial Avenues

For both sellers and buyers, comprehending the sectors experiencing robust financing activity in FY23 is crucial, highlighting a consistent demand for SBA support. Allen pinpointed these insights to aid business owners in contemplating their next moves.

SBA’s Vision for Tomorrow: Adapting to Market Shifts

The SBA is far from complacent. It continually adapts to market trends, economic indicators, and the evolving needs of small businesses. Its strategic outlook aligns with the changing business landscape. The emphasis lies on providing flexible financing options, extending outreach to underserved communities, and nurturing entrepreneurship to meet the evolving requirements of businesses.

Unleashing the Potential of SBA Programs: Empowering Your Journey

Allen provided an exhaustive overview of various SBA programs designed to bolster business expansion through mergers and acquisitions. These programs encompass the SBA 7(a) Loan, SBA 504 Loan, SBA Microloan, SBA Express Loan, SBA CAPLines, and SBA Export Loan Programs. For sellers and buyers, these programs offer flexible financing options, reduced down payment requirements, extended loan terms, and favorable interest rates.

Recent Transformations in SBA Programs: Staying Well-Informed

In the ever-evolving realm of business, staying current with SBA program changes is indispensable. Allen underscored significant recent revisions, including streamlined affiliation rules, heightened loan limits, and fresh underwriting options. The permanent status of the Community Advantage program is a noteworthy assurance, ensuring ongoing support to underserved communities.

When selecting a business broker or a M&A advisor, ensure they have a firm grasp of the SBA’s inner workings and programs. Whether you’re selling your business or exploring a new acquisition, the SBA’s adaptable programs and market-savvy approach are essential for successfully navigating the intricate world of business transactions. With its mission to support small businesses and enhance access to capital, the SBA is a key player in the realm of business transactions.